Overview

ACI and partners seeking a farm-in to fund the geo program costs for airborne survey, geophysics, drilling and other components for the Iron Oxide Copper Gold (IOCG) project to be developed into a world class mine similar to BHP Billiton’s Olympic Dam project in Australia.

The ore is a IOCG with 10 pay metals (Copper, Gold, Silver, Platinum, Palladium, Cobalt, Molybdenum, Iron, Zinc and Vanadium). It is a polymetallic ore with the three most prominent from pit samples Gold values of up to 2 grams/mt, Copper up to 4% (Cu Sulphides & oxides) and Siver all at the surface (in comparison, the largest copper mines in the world have average copper grades of 0.67% contained copper with big tonnage).

The Copper/Gold Value calculations report estimated for area 500m lengths x 300m width x various depths of seam potential of (10m, 50m & 100m):

Copper grades range from 0.8 to 4.0% and gold up to 2grams per mt as per surface samples in NI-43-101 report. Other pay metals of PGMs, Silver and Cobalt not used in these calculations for valuations but are significant.

For these calculations Copper grade 2.0% used. For Gold 0.5 gram/mt used. Example Copper & Gold volumes & values in Copper Clearing area around Pits #1 & Pit #2:

EXAMPLE #1:

Volume & Value of 10 meter depth ore seam:

Copper Value: L-500m x W-300m x D-10m = 1,500,000m3 x 2.2sg = 3,300,000mt ore x 2.0% = 66,000mt Cu x US$7,000/mt = US$462,000,000;

Gold Value: 3,300,000mt x 0.5gram/mt = 1,650,000grams x US$50/gram = US$82,500,000.

EXAMPLE #2:

Volume & Value of 50 meter depth ore seam:

Copper Value: L-500m x W-300m x D-50m = 7,500,000m3 x 2.2sg = 16,500,000mt ore x 2.0% = 330,000mt Cu x US$7,000/mt = US$2,310,000,000;

Gold Value: 16,500,000mt x 0.5gram/mt = 8,250,000grams x $50/gram = US$412,500,000.

EXAMPLE #3:

Volume & Value of 100 meter depth ore seam:

Copper Value: L-500m x W-300m x D-100m = 15,000,000m3 x 2.2sg = 33,000,000mt ore x 2.0% = 660,000mt Cu x US$7,000/mt = US$4,620,000,000;

Gold Value: 33,000,000mt x 0.5gram/mt = 16,500,000grams x US$50/gram = US$825,000,000.

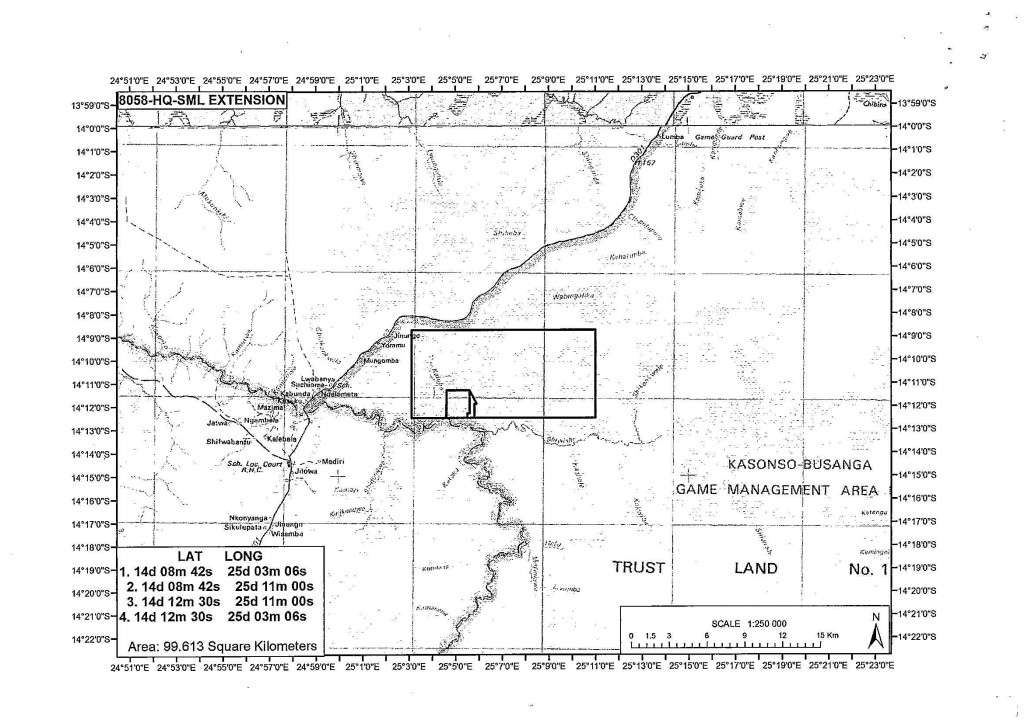

NB: Similar IOCG mineralizations are found near at Kalengwa 70km to the north of Kafwego and 200km to the Southeast at the Blackthorn exploration project.

Prosposal to Investor: 48/52 Joint Venture

Investment: US$10,000,000

Terms:

Investor purchase 52% earned Beneficial Interest in Kafwego site for US$10,000,000.

Paid as follows:

1st Option:

a) US$3,000,000 for 20% Beneficial Interest in project. Paid as follows:

b) US$1,000,000 commitment fee: earned Beneficial Interest: 8%

c) US$2,000,000 Qualified Geological Exploration Expenditures

Our partnership or Investor’s geological team to complete NI 43-101 or JORC

compliant Geological report with minimum 6000 meter drill program to quantify pay

metals within IOCG deposit: Investor’s earned Beneficial Interest: 12%

Total earned Beneficial Interest: 20%

2nd Option:

$7,000,000 for additional 32% earned Beneficial Interest in project after Geo results.

Total Investment: US$10,000,000. Total earned Beneficial Interest: 52%

3rd Option:

Investor and the partnership sell off asset and split the proceeds 52/48 as per above Beneficial ownership.

Partnership and Investor retain a Net Smelter Royalty (NSR) of 2%.